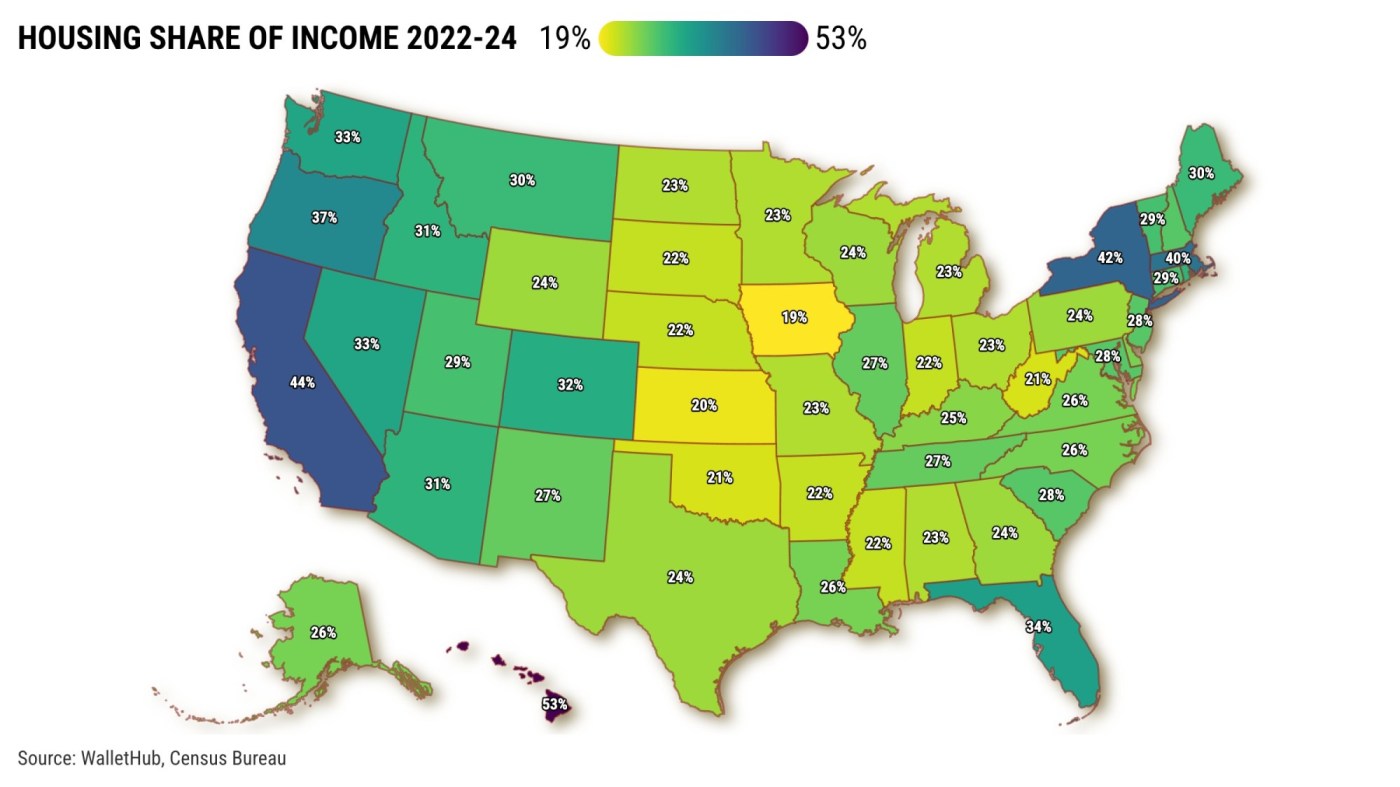

There’s only one place outside of California where you’ll spend more of your paychecks on housing.

My trusty spreadsheet calculated how much typical households spend on housing expenses by reviewing a cost study from WalletHub and homeownership levels from the Census Bureau.

Related Articles

‘Change is inevitable’: Berkeley OKs demolition of historic theater

San Jose housing project will switch to affordable units

Supportive housing project in Oakland pushes ahead with property deal

‘A disaster:’ This Bay Area city is rolling back a big tax break for ‘affordable’ housing project

Opinion: Criminalizing homelessness won’t fix our housing shortage

The math shows housing expenses eat up 44% of a typical California household budget. Only Hawaii at 53% was higher. No. 3 was New York at 42%, Massachusetts at 40% and Oregon at 37%. One big California rival, Florida, was No. 6 at 34%.

The national median was 26%. Iowans spend the smallest share on the roof over their heads at 19%, then Kansas at 20%, and West Virginia and Oklahoma at 21%. California’s other major economic competitor, Texas, was No. 34 at 24%.

How did we get there?

First, WalletHub says Californians who lives in their own place have the nation’s second-highest ownership costs, spending 46% of their incomes on the place they own.

Only Hawaii at 53% is higher. No. 3 is Oregon at 36%, then Nevada and Washington at 35%. Florida is 13th highest at 30%.

American homeowners spend 26% of their income on house costs. Iowa is the lowest at 19%, then West Virginia, Kansas, and Nebraska at 20%. Texas is 20th lowest at 23%.

Next, note that California tenants fare a tad better in WalletHub rent rankings, with the nation’s sixth-highest costs at 42% of their income going to the landlord. Topping the Golden State are New York at 55%, Hawaii at 53%, Massachusetts at 49%, Florida at 43%, and Maine at 42%.

Nationally, tenants typically put 28% toward rental expenses. Folks in Kansas and Iowa spend the least at 19%, followed by Wyoming at 20%. Texas is 17th lowest at at 25%.

And finally …

To meld owner and renter costs into an overall housing expense yardstick, we adjusted the aforementioned expenses using a state’s homeownership rate.

Again, ownership stats are not great for California. It ranked second-worst with an average 55% of residents living in a home they owned in 2022-24.

Only New York was worse at 53%. After California came Hawaii at 60% and Nevada at 61%. Texas was seventh-lowest at 63%. Florida was 20th-lowest at 68%.

Nationally, the median ownership was 69% with highs of West Virginia at 78% and Delaware, Mississippi and Maine at 75%.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]