SAN JOSE — Signia by Hilton San Jose, which was foreclosed due to a failed real estate loan, could be back on the sales block as soon as 2026, after next year’s major sporting events in the region conclude.

In May, an affiliate of BrightSpire Capital foreclosed on a delinquent $134 million loan for the 541-room hotel at 170 South Market St. in downtown San Jose.

RELATED: Foreclosures, defaults undermine hotel deals in Bay Area, California

BrightSpire took ownership of the tower through a proceeding that placed an $80 million value on the property. The foreclosure was completed after two federal bankruptcy proceedings and a Santa Clara County Superior Court lawsuit, all three of which were filed by the hotel’s previous ownership group.

Related Articles

Former Birkenstock site in Marin County sold to Eames Institute for $36 million

Foreclosures, defaults undermine hotel deals in Bay Area, California

Soup kitchen buys San Jose property to meet rising demand

South Bay apartment hub bought in deal that tops $60 million

San Jose property leased to IHOP restaurant lands local buyer

The prospect that the hotel might be offered for sale was among the topics discussed by BrightSpire Capital executives during the real estate finance firm’s conference call regarding its latest financial results.

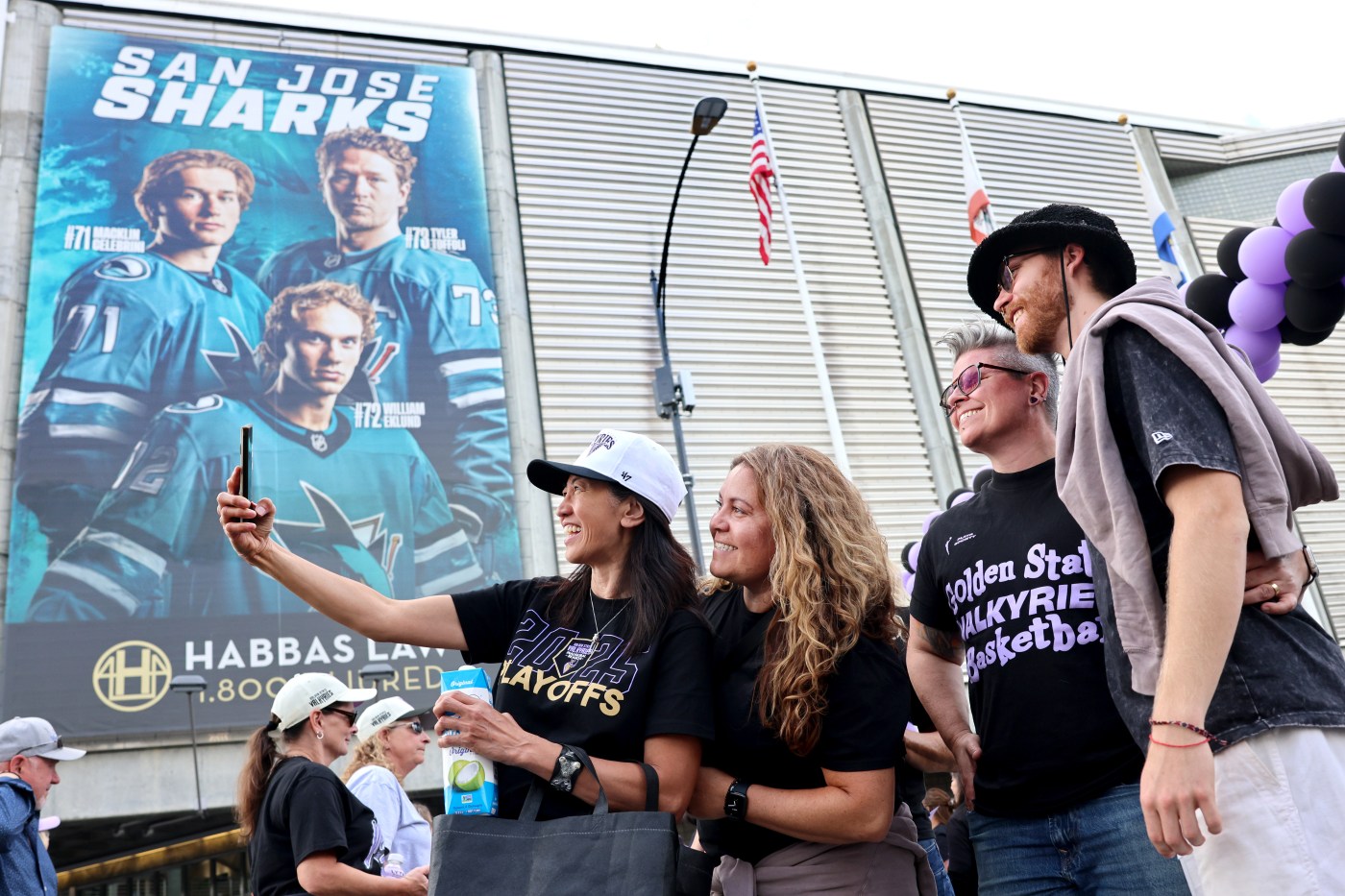

A sale could occur after the hotel potentially generates heightened revenue from events scheduled for the first half of 2026. The Super Bowl, one of the rounds of the NCAA men’s college basketball tournament, and several matches of the FIFA World Cup are poised to draw fans to the South Bay.

Once complete, BrightSpire intends to scout for a buyer, the company told Wall Street analysts who participated in the conference call on July 30. During the call, BrightSpire executives provided updates on the hotel’s recent financial status and potential plans for the future.

“Our intention is to make much-needed and neglected physical and operational improvements to the property ahead of significant events taking place in the Bay Area through mid-2026,” BrightSpire CEO Mike Mazzei told analysts. “We want to do things that we need to do to get that hotel fully operational and in peak condition before those events.”

The hotel fell into some level of disrepair because the prior ownership group was preoccupied with the three court proceedings that were filed in an attempt to retain control of the property, according to BrightSpire.

“During the protracted foreclosure process, the hotel experienced meaningful deferred maintenance,” Mazzei said. “There was some distress at the asset. There were just basic things like elevators. Some elevators were not operating and offline.”

BrightSpire expects it will be busy in the coming months to bring the hotel up to par ahead of the major sporting events.

“We are going to be investing capital over the next six months into the hotel for deferred capital expenditures and things that need to be addressed,” Mazzei said. “I think we’ll look to potentially sell the hotel sometime in mid-2026, but we don’t really have a timeline for it yet.”

Signia by Hilton San Jose is generating a profit. BrightSpire explained during the conference call that the hotel’s operating revenue exceeds its operating expenses.

BrightSpire’s suggestion that it might pursue a sale arrives at a time when hotel values are under pressure in California and the Bay Area from a wave of loan delinquencies and foreclosures, according to a new report produced by Atlas Hospitality Group.

An estimated 113 hotels were bought in the first half of 2025 in California, down 7.4% from the 122 hotels that traded hands statewide over the similar period in 2024, Atlas Hospitality Group stated.

During the first six months of 2025, average purchase prices in California were about $149,800 per room, a decrease of 16.4% from the $179,200 price per room over the first half of last year, the survey determined.

“California individual hotel sales continue to lag,” Alan Reay, president of Atlas Hospitality, which tracks the statewide lodging market, wrote in the report. “Higher interest rates and continued disconnect between buyer and seller price expectations continue to create downward pressure on hotel sales transactions.”