(Bloomberg/Suvashree Ghosh) — Major cryptocurrencies retreated to drag the market’s total value below $4 trillion after it scaled record heights last week.

Bitcoin fell as much as 2.5% to about $115,000 while Ether, the second-largest token, at one point shed more than 5% to dip below $4,300 on Monday. The combined value of all cryptocurrencies sank to $3.9 trillion, according to CoinMarketCap.

The losses come after Bitcoin hit a record $125,514 on Aug. 14, while Ether on the same day pushed to within $100 of its own all-time high set in November 2021. The two leading tokens had been buoyed by a spree of institutional investment led by so-called digital-asset treasury companies — listed vehicles whose purpose is to create stockpiles of cryptocurrency. Michael Saylor’s Strategy, the original crypto hoarder that’s inspired a flood of imitators, has amassed more than $72 billion worth of Bitcoin. Strategy announced Monday that it purchased $51.4 billion of Bitcoin from Aug. 11 to Aug. 17.

Related Articles

For Silicon Valley, falling behind in AI is a bigger threat than tariffs

You can now lease an EV for less than $100 a month

Bay Area and California bounce back with July job gains after June loss

Archer Aviation expands in San Jose with lease of foreclosed offices

Top Silicon Valley exec reveals the ‘stupidest thing’ companies adopting AI can do

The market “has seen continued profit-taking since a new all-time high printed last week,” said Caroline Mauron, co-founder of Orbit Markets, adding that “the momentum behind the crypto treasury boom appears to be losing steam.”

Metaplanet Inc., the Japanese hotel operator that’s so far accumulated $2.2 billion of Bitcoin, is down around 50% from a mid-June high.

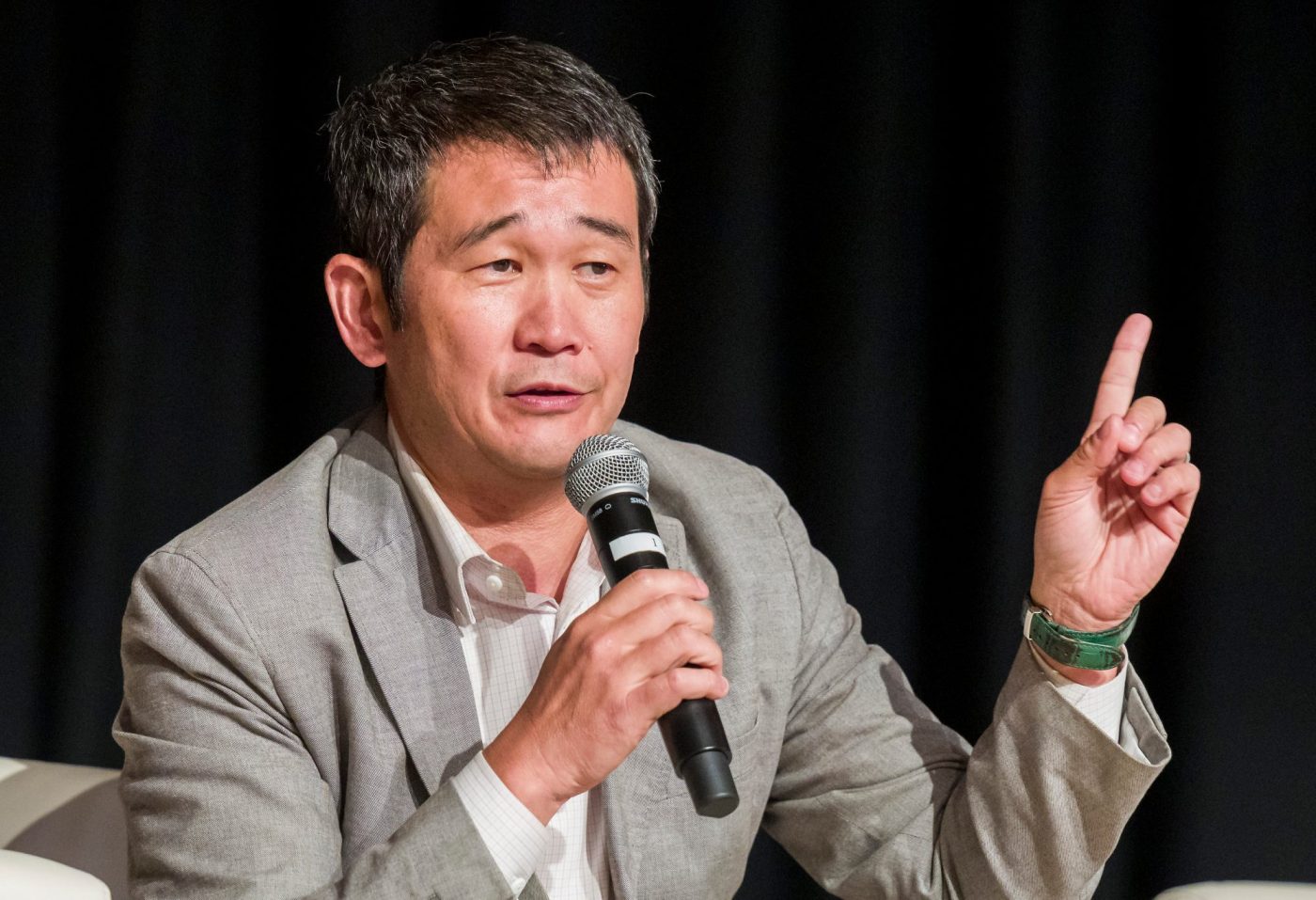

Meanwhile, BitMine Immersion Technologies Inc. said Monday that it’s crypto holdings exceeded $6.6 billion. The company, headed by Thomas Lee – a well-known financial television contributor and founder of financial research firm Fundstrat – began accumulating Ether in June. Shares of the Las Vegas-based firm have surged more than 600% this year.

–With assistance from Sidhartha Shukla.

More stories like this are available on bloomberg.com

©2025 Bloomberg L.P.