“This isn’t 2008!”

It’s a common refrain from real estate gurus when talking about the fragility of California’s housing market.

Well, housing and economic conditions today may not be exactly like 2008 – shorthand for the financial disaster that popped that decade’s real estate bubble, creating the Great Recession. Yet, that ugly housing era wasn’t the Golden State’s only real estate debacle.

Many people can’t – or won’t – recall how bad California’s housing market was in the 1990s, a real estate slump that had plenty in common with the current economy.

Well, this jaded, old journalist remembers when the California boom of the late 1980s ended with a thud — a painful start to a recessionary decade. Call it another reminder of California real estate’s risks.

There was a loss of lending support. Like the Federal Reserve’s recent end to its mortgage-buying program, the late 1980s demise of the nation’s savings and loan industry – key real estate lenders, especially in California – made financing harder to get as the 1990s unfolded.

Then, similar to 2025’s trade war, international change brought economic pain.

The end of the Cold War with the Soviet Union translated domestically to dramatically less defense spending in the 1990s. That slashed jobs in the previously flourishing manufacturing sector, especially the aerospace firms in California.

Let my trusty spreadsheet illustrate the impact of those economic losses on home prices, as measured by data from the California Association of Realtors and various government agencies.

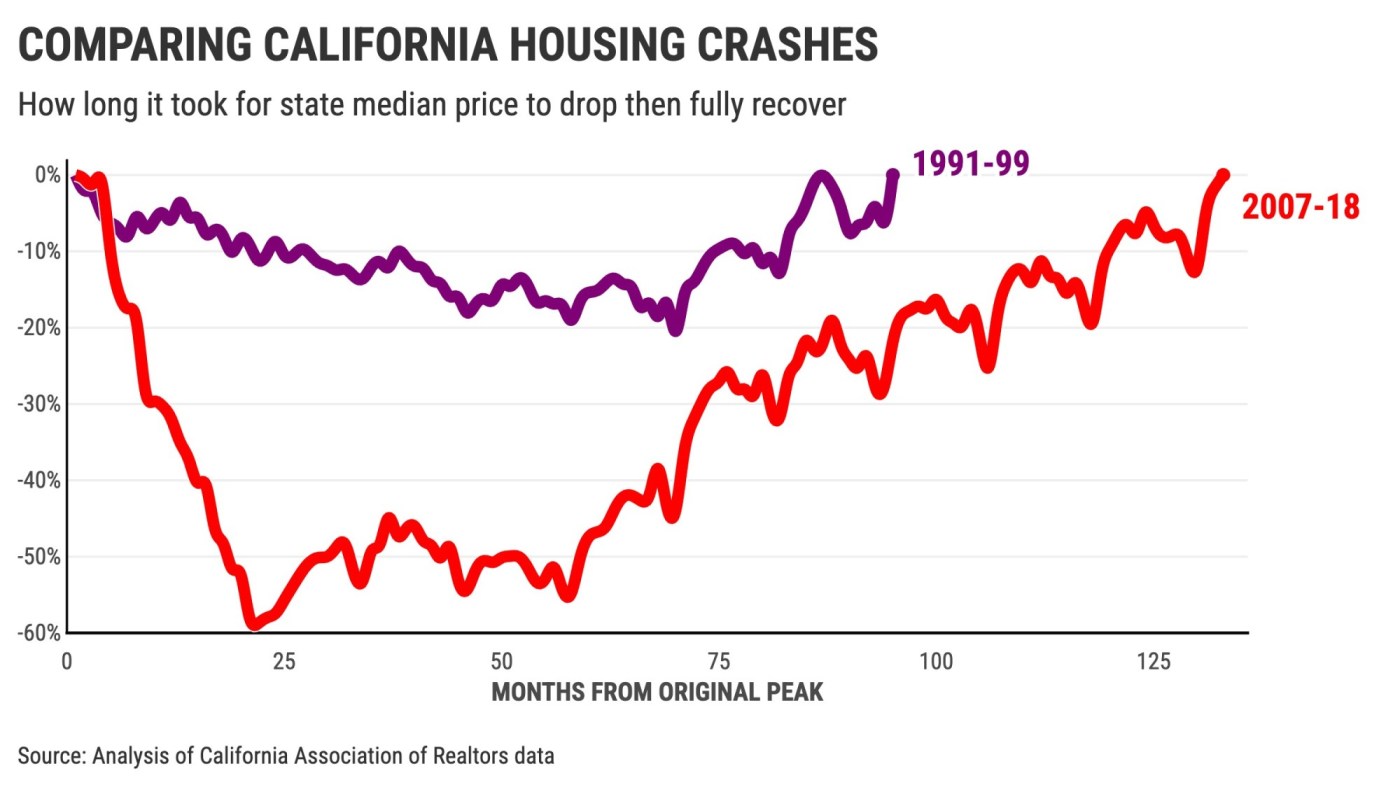

In May 1991, the statewide median sales price of a single-family home hit a record $211,000. It would take almost eight years for a new record to be set at $212,300 in March 1999.

That’s zero appreciation over almost eight years. Zero.

The 1990s plummet was slow pain. Its bottom wasn’t hit until February 1997 at $167,800 – 20% off the 1991 peak.

Ugly follow-up

The 1990s would be remembered as a legendary crash if it weren’t for what happened next.

The California economy, notably dot-com tech stocks and the housing market, took off in the late 1990s.

Housing had a secret salve: all sorts of easy-to-get mortgages. Aggressive lending even allowed the housing market to brush off the 9/11 terror attacks and the dot-com stock crash as the 2000s began.

By May 2007 – a little over eight years since the 1990s debacle ended – the statewide median had set a new pinnacle at $594,500. That’s nearly triple from the last crash’s end.

However, in mid-2007, easy mortgages disappeared, leaving behind a wave of foreclosures. The world’s financial markets bet heavily on those risky home loans. And when those mortgage bets imploded, so did the global economy in 2008.

California housing got clobbered. In less than two years – in February 2009 – the market bottomed with a $245,200 median. That’s a 59% drop. Yes, 59%.

California home prices didn’t reach a new peak until May 2018 at $600,900. That’s 11 years with zero appreciation.

Since then, prices have increased by 50% to $900,200 as of May 2025.

Help wanted

Remember what drives housing: Jobs. Jobs. Jobs.

California’s two eye-popping home price crashes featured extended periods with no new paycheck creation.

In December 1990, California employment peaked at 12.6 million workers. The next record was set in November 1995.

That’s five years without adding to the job tally – essentially a hiring freeze tied to sharp cuts in defense, construction and finance. At the time, it was the longest hiring flatline since World War II.

But then came California’s booming tech businesses, which were only temporarily derailed by the dot-com mess. Real estate industries, fueled by easy-money loans, reversed gears. Other employers joined the hiring spree.

Statewide employment ebbed and flowed up to 15.6 million by December 2007. Then housing collapsed. Other businesses followed, and the Great Recession was underway.

This California employment peak wasn’t exceeded until October 2014. An economic storm that extended well beyond real estate made for an almost seven-year job-creation drought, topping the 1990s dry spell.

Two housing-crash eras encompass a dozen no-growth years for job seekers. In the other 23 years since 1990, California averaged 250,000 new jobs annually.

Or think about statewide unemployment.

Joblessness averaged 7.8% in the 1990s crash. It was 8.3% in 2007-2018. And all other times since 1990? Just 5.8%.

Please note that the recently healthy job market is one largely overlooked reason why today’s California housing is simply languishing, not collapsing. California joblessness averaged 5.3% in early 2025.

Real numbers

How ugly do basic housing metrics look during California crashes?

Well, start with this. We discussed two lengthy periods of zero price appreciation. All other times since 1990, the California median price surged at an average 10% annual rate.

So housing’s either flopping or popping. And it’s up at just a 2% annual rate in 2025’s first five months.

What gets owners in a selling mood? Crashes do the job, according to a Realtors’ inventory metric.

During the 1990s stagnation, it would take an average of 9.7 months to sell all the California homes on the market. During the 2007-2018 implosion, inventory averaged 5.1 months.

All other times since 1990? Listings equal just 3.5 months of sales. And 2025’s start? 3.8 months.

Sellers must be patient in crashes, looking at Realtors’ average days on market stats.

Owners waited 63 days in the 1990s mess before signing a sales contract. It was 40 days around the Great Recession.

In other times, though, it was only 29 days – including 25 to start this year.

Mortgage madness

Cheaper financing amid these calamities helped fuel the market’s eventual recovery.

In the 1990s bust, the 30-year fixed mortgage, as tracked by Freddie Mac, went from 9.5% to as low as 6.7% – a 30% boost in a borrower’s buying power. Rates finished this ugly period at 7%.

During the 2007-2018 blowout, rates that started at 6.3% dropped to 3.4% – a 40% boost in a borrower’s buying power. Rates rose back to 4.5%.

Consider how this compares with the pandemic.

In January 2020, just before the coronavirus upended the economy, mortgages were at 3.6%. Fears of another housing collapse prompted the Fed to take extraordinary measures, slashing rates to 2.7% by year’s end. But that was only a 13% boost to buying power.

To 2025 house hunters, that’s the good old days.

Who can buy?

Today’s crushing lack of homebuying affordability is driving California’s housing fears.

Mortgage rates run around 6.5% as prices remain near all-time highs. Contemplate “affordability” as measured by California’s Realtors, a mix of prices, rates and incomes.

In 2025’s second quarter, the math shows just 15% of households statewide could comfortably buy the $905,700 median-priced, single-family house.

Contrast that to the start of the 1990s debacle. The Realtors’ affordability index was at 22%. And the Great Recession’s slide began with 11% affordability.

Remember, “affordable” means “cheaper” housing. And price crashes create opportunity.

In the 1990s tumble, California’s affordability peaked at 44%. The Great Recession’s high was 56%.

That’s why some house hunters dream of another 2008. Or the 1990s.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]

Related Articles

San Jose begins clearing its largest homeless camp

Early results show Prop 36 struggling with ‘mass treatment’ pledge for homeless drug offenders

What $1,800,000 bought on Pleasant Street: A Santa Clara County home

Republican candidate for governor Steve Hilton visits San Jose homeless camp, bashes Democrats

Single-family residence in Milpitas sells for $1.5 million