Companies owned by President Donald Trump have declared bankruptcy six times, a reminder that a corporation that defaults on repaying money it has borrowed is often forced into bankruptcy court.

Several California cities, including Stockton and San Bernardino, that unwisely made pension promises to their employees that they could not keep also wound up before a federal bankruptcy judge.

And then there’s California’s state government.

Five years ago, California borrowed $20 billion from the federal government because its unemployment insurance system didn’t have enough money to pay a strong surge of claims. More than two million Californians had lost their jobs after Gov. Gavin Newsom forced many businesses to shut their doors due to the COVID-19 pandemic.

Related Articles

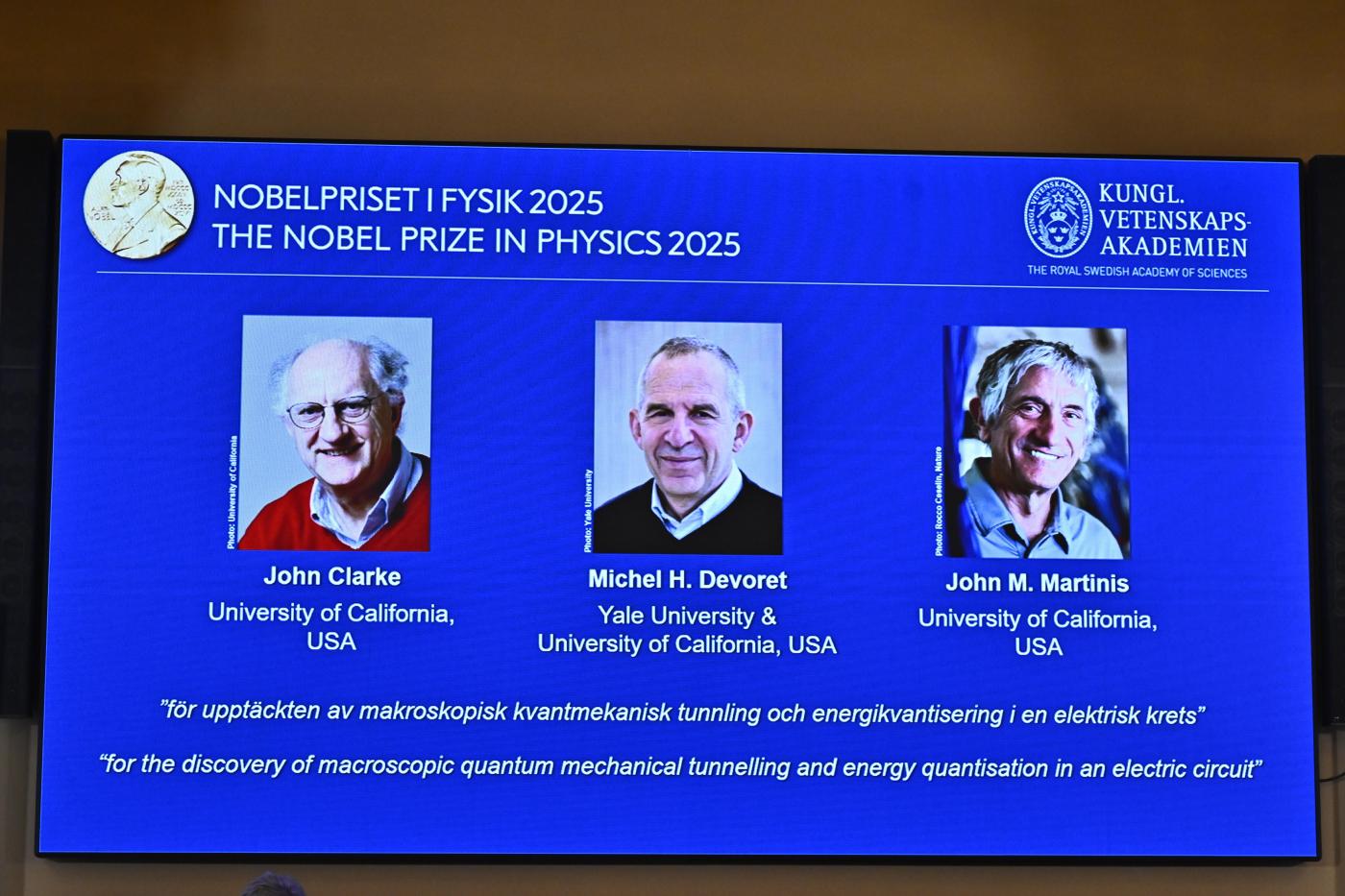

Newsom signs legislation to bolster fusion, quantum technologies

Will your congressional district change if Prop. 50 passes? Use these maps to find out

In California, paying someone to vote could result in a $10,000 fine or jail

Will new California law prevent gas price spikes?

This bill has been hailed a ‘landmark’ victory for Bay Area YIMBYs. But it only narrowly escaped defeat

California was not alone in borrowing to maintain benefits for jobless workers, although no other state approached its huge debt, and all others — most recently New York and Connecticut — have repaid their loans. And California’s debt is still increasing.

Even though the state’s unemployment rate, currently at 5.5% of its workforce, is just a third of what it was in 2020, it’s still the nation’s highest, with more than a million jobless workers. California’s Employment Development Department is paying out $7.4 billion to those covered by unemployment insurance this year while collecting less than $5 billion in payroll taxes.

California’s debt will reach $23.2 billion by year’s end, according to the state’s most recent report, and it’s likely to grow even more in 2026. The state’s also on the hook for more than $600 million a year in interest.

Since California hasn’t repaid its loans and is still borrowing money, federal officials have hiked payroll taxes on California employers. As the California Business Roundtable recently noted in a report, the state’s employers will soon pay a 5.2% payroll tax — nearly nine times as much as those in other states that are debt-free — plus their state payroll taxes.

This is a gigantic mess born of shortsighted political decision making and cowardice.

A quarter-century ago, California had a comfortable surplus in its Unemployment Insurance Fund but the Legislature and then-Gov. Gray Davis began draining it with a sharp increase in benefits.

When the Great Recession struck the state a half-decade later, the fund was quickly exhausted and California borrowed about $10 billion to keep benefits flowing, eventually to be repaid through an increase in federal payroll taxes.

However the fund never regained substantial reserves because even after recession ended, benefits continued to take everything the state was collecting via payroll taxes.

Meanwhile there was a political stalemate, pitting employers against unions over what should be done about the income/outgo conundrum that continues to this day.

There’s a widespread belief, even among officials who should know better, that California unemployment insurance debt stems from billions of dollars in fraudulent claims that also occurred during the pandemic-caused recession.

In fact, the fraud, while real, involved a separate program of extended benefits financed completely with federal recovery funds. California’s huge debt involves only the state’s unemployment insurance system.

It’s questionable whether employers should even be on the hook to repay the loans, because the underlying surge in unemployment was caused entirely by the state-ordered business shutdowns, not a natural recession or employer-ordered layoffs. It’s a cost that should have been born by the state budget, like other impacts of pandemic.

Financing unemployment insurance benefits with federal loans and imposing taxes on employers to service the debt cannot continue indefinitely. It also leaves the system vulnerable to any future economic downturn.

The crisis is another reminder of California’s chronic lack of accountability for wrong-headed governance.

Dan Walters is a CalMatters columnist.