Click here for a complete list of our Nov. 4 election recommendations.

Southern Alameda County’s Washington Township Health Care District is coming up short each year and now its leaders want to turn to property owners to make up the difference.

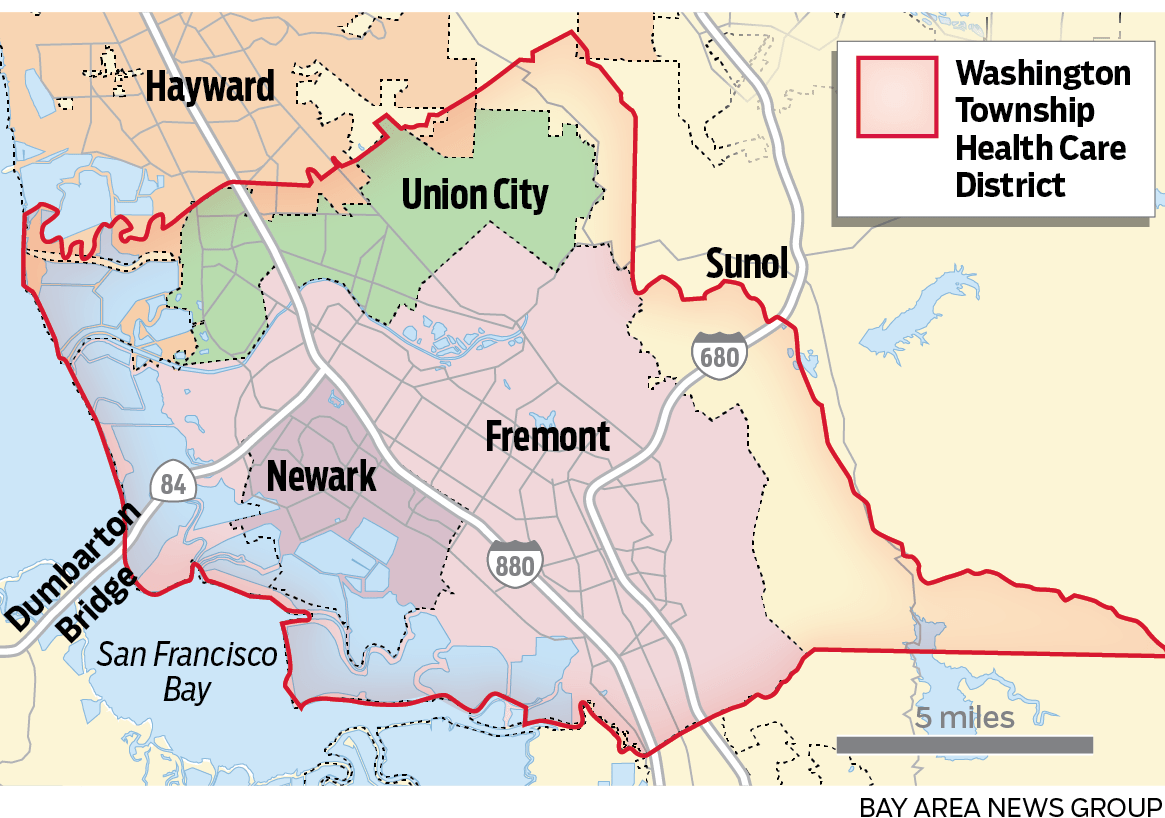

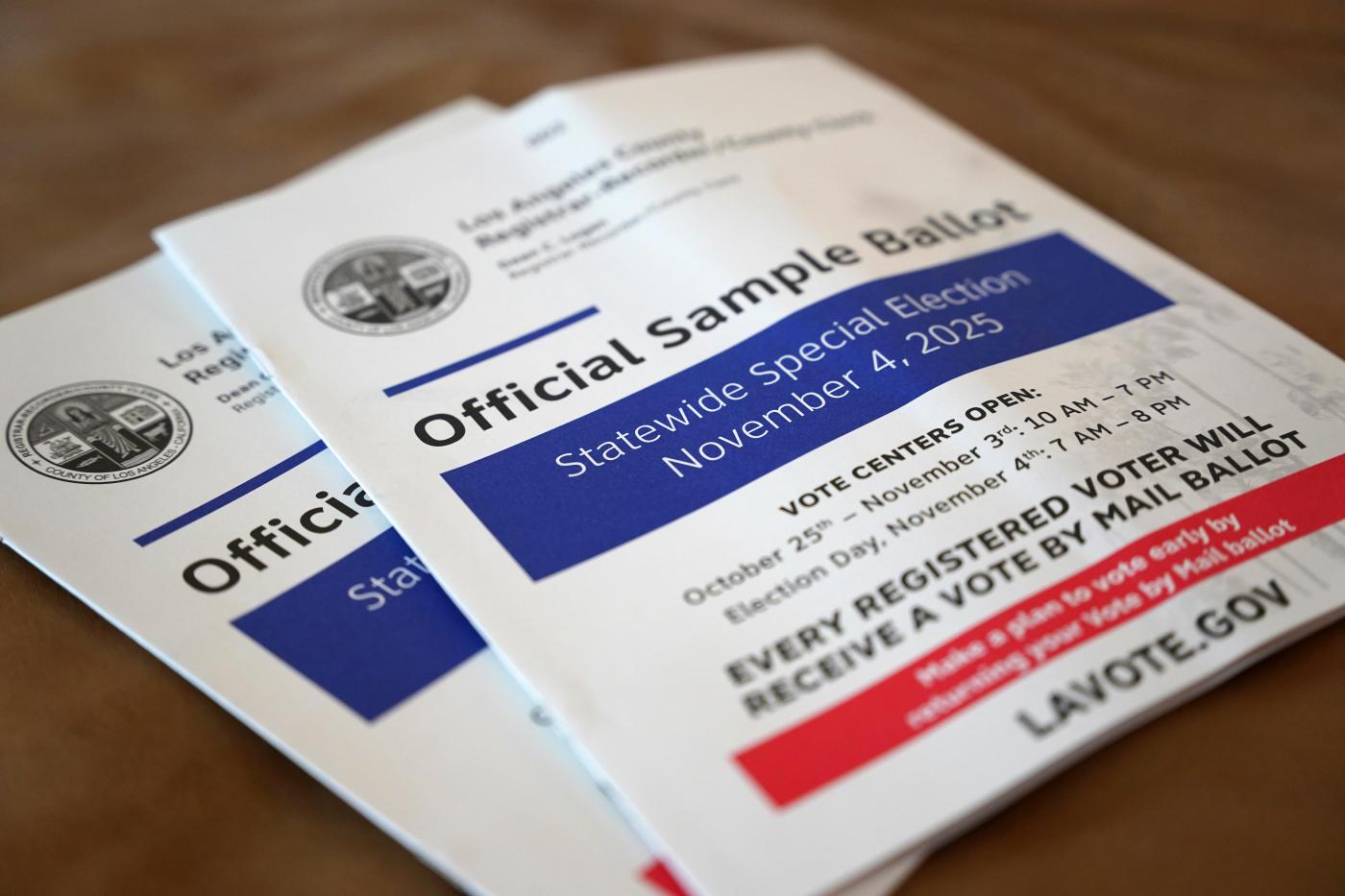

Measure B on the Nov. 4 ballot in Fremont, Newark, Union City and a small part of South Hayward would impose a parcel tax of $5 per 100 square feet of building area. For an average size single-family house in the district, that’s about $90 annually. The tax would last for 12 years.

Related Articles

Proposition 50 and more: Our endorsements for California’s Nov. 4 special election

Editorial: The reason to vote no on Santa Clara County Measure A

But the district’s arguments for the measure are misleading, and officials are unwilling to discuss specifics of how they plan to address their financial shortfall, which is more than twice as big as the revenue expected from the new tax. Voters should reject Measure B.

The district, formed in 1948, today operates a 415-bed acute care hospital. For the current and past two fiscal years, the district shows operating losses of about $30 million annually, or about 3.5% of its operating expenses. Measure B would cover about $13 million of that shortfall.

Those taxes would be on top of the district’s bond program, which voters in 2020 agreed to increase to pay for hospital seismic improvements. To cover the cost of the bonds, property owners this fiscal year will pay $21.80 per $100,000 of assessed value, or about $167 for a home with a district-average assessed value.

The bond tax will likely increase as the district borrows more money to finance construction of a new seismically sound hospital tower for patient rooms.

But the issue on the ballot this year is money to cover the shortfall for hospital and other health care operations.

District operating expenses have increased 24% over the past three years. Officials blamed rapidly escalating salary-and-benefit costs and said they had to lay off employees last year. But staffing data shows the total employee count has been increasing steadily and is now 15% above pre-pandemic levels.

Meanwhile, district revenues have increased 26% over the same three-year period. Officials first claimed that revenues were being dragged down because the district had experienced, since before the start of the pandemic, a huge shift to patients under government insurance like Medicare and Medi-Cal. That turned out to be flatly wrong when we pressed for supporting data.

There is no question that health care finances are challenging and are about to become more difficult with the recent federal cuts to Medicaid. And the hospital has taken on more responsibility with its 2022 designation as the trauma center for southern Alameda County.

But it’s not clear how the district plans to eliminate its budget shortfall. Asked about future financial plans, district CEO Kimberly Hartz said, “you can’t save your way out” of this problem. The solution, she said, is greater efficiency and creating new programs to bring in revenue.

Yet she declined to identify those new programs or provide financial forecasts, citing competitive pressures with other hospitals.

In other businesses, we might be sympathetic to arguments of proprietary information. But, in this case, hospital officials are essentially asking taxpayers to invest. And taxpayers deserve to know what they’re investing in.

Without clear answers, voters should reject Measure B.