(Bloomberg/Dinesh Nair) — The arms race in artificial intelligence has increased the likelihood of a $100 billion-plus M&A deal by this time next year, according to the top dealmaker at Barclays Plc.

“There will be transactions that defy our imagination within the broader AI spectrum,” Andrew Woeber, global head of mergers and acquisitions at the British lender, said in an interview. “Don’t be surprised to see a $100 billion plus deal within the next year. Big platforms are going to make big bets.”

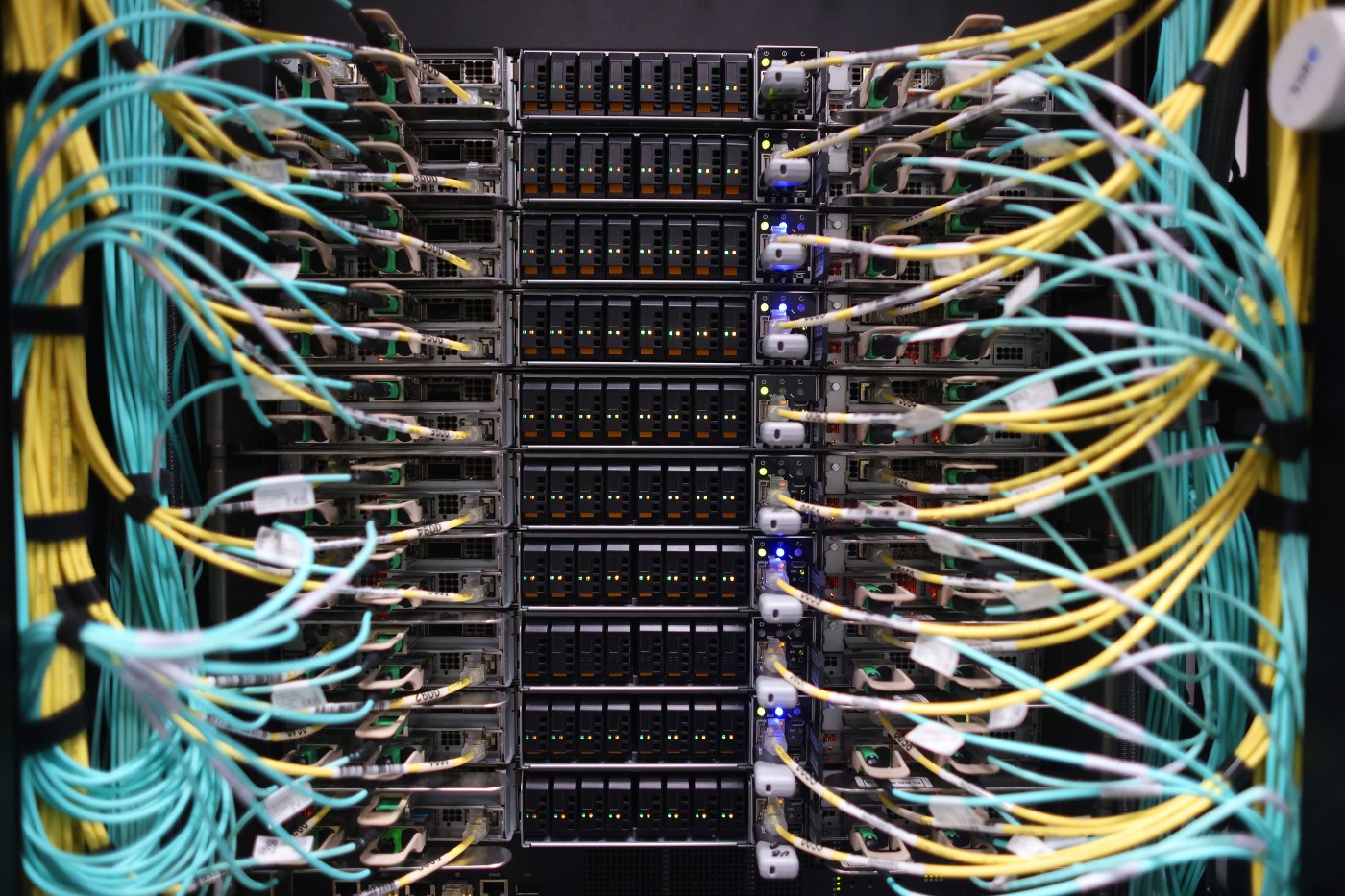

Technology companies such as Elon Musk’s xAI Corp. and Meta Platforms Inc. have already committed billions of dollars in capital to invest in data centers and related infrastructure to support the AI boom. Morgan Stanley estimates such spending could exceed $3 trillion over the next three years.

Related Articles

Magid: Roblox to estimate age of all users

Tesla says its robotaxi app now open to public riders

2 California residents plead guilty in $16 million Apple warranty fraud scheme

California lawmakers kill plans to curb AI-manipulated prices

Judge allows cutting-edge DNA technology, pioneered by Santa Cruz company, in case against suspected serial killer

Were a 12-digit deal to come along, it would be the largest in any sector since AT&T Inc.’s acquisition of Time Warner Inc. for around $110 billion including debt, which completed in 2018, data compiled by Bloomberg show.

Big transactions won’t be limited to the AI industry, according to Woeber, who said that chief executives and boardrooms in general are looking beyond the uncertainty in markets and thinking about strategic deals that can boost growth.

Companies globally have announced more than $1 trillion of deals since June, defying the normal slowdown in the summer months. That’s the highest tally for this spell since the record-breaking 2021. The period has included the biggest deal announced so far in 2025: Union Pacific Corp.’s agreement to acquire railroad operator Norfolk Southern Corp. for more than $80 billion including debt.

The surge in dealmaking marks a significant shift from the early months of the year, when volatility driven by US President Donald Trump’s trade wars dampened initial enthusiasm around M&A. Momentum has continued into September. Just this week, CapVest Partners agreed to buy control of German drugmaker Stada Arzneimittel AG, while Kraft Heinz Co. announced it will split into two publicly listed companies to streamline its operations.

“The mood of our clients has clearly shifted from caution to confidence and action,” Woeber said. “In the last few months, we have seen a major acceleration in deal activity that continues to build.”

Woeber is a former Centerview Partners banker who has also held senior roles at Greenhill & Co. and Morgan Stanley. He joined Barclays earlier this year as part of the bank’s plan to strengthen its advisory business after losing ground to rivals. Under Cathal Deasy and Taylor Wright, global co-heads of investment banking, Barclays has been snapping up bankers — especially those focused on energy transition, industrials, health care and technology.

There are signs that those efforts are paying off. The bank has had roles on some of the largest deals this year, including Alphabet Inc.’s $32 billion purchase of cybersecurity startup Wiz Inc. and Constellation Energy Corp.’s acquisition of Calpine Corp. for about $29 billion including debt. Woeber said the list of potential transactions that the bank is working on is growing at a rapid pace.

More stories like this are available on bloomberg.com

©2025 Bloomberg L.P.