MOUNTAIN VIEW — A big Mountain View tech campus has been seized by its lender in a loan failure that is a reminder of persistent weakness for the Bay Area office market.

Citi Real Estate Funding, which had provided the loan that was foreclosed, took ownership of the property through a foreclosure proceeding on Sept. 17.

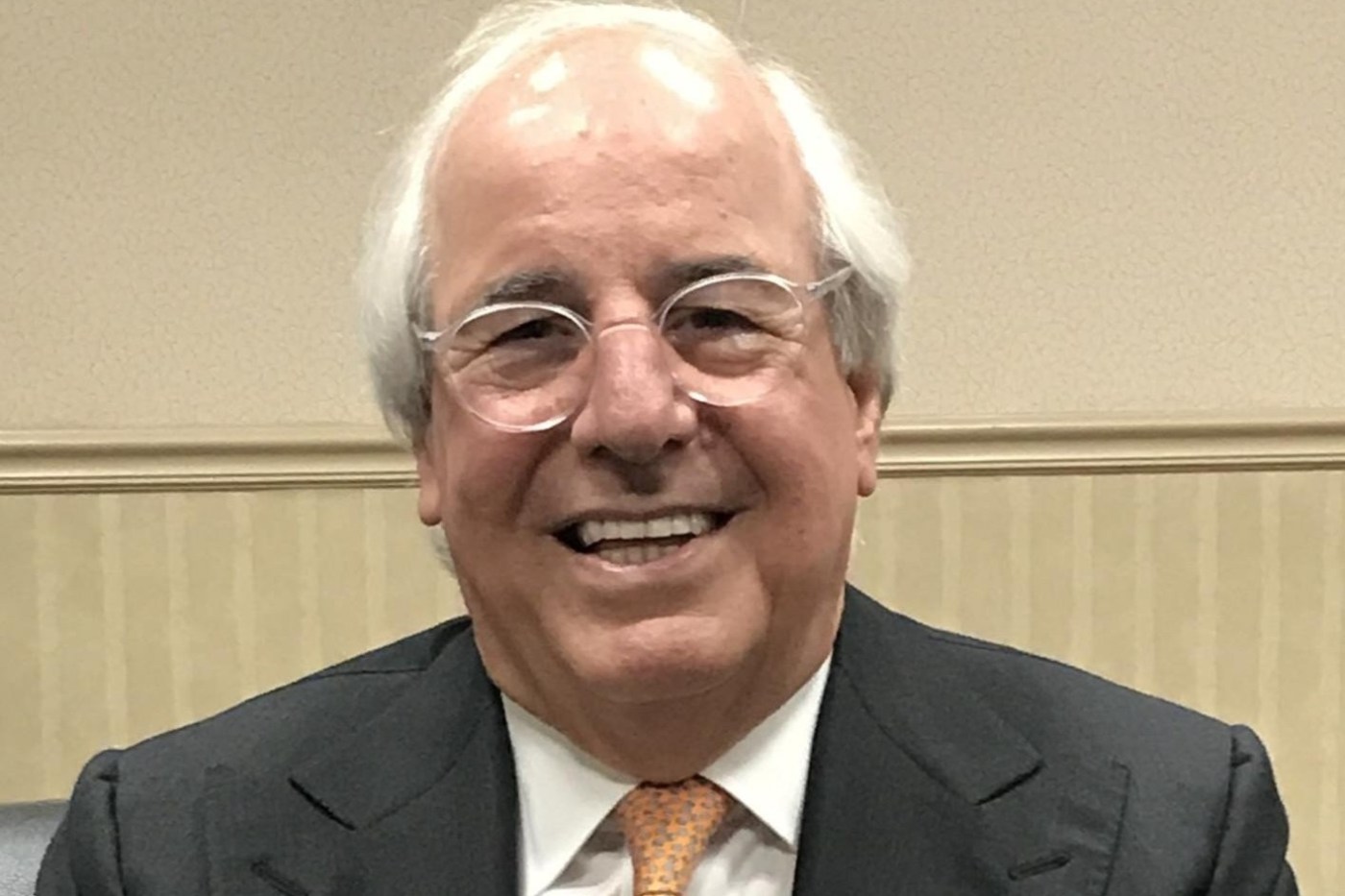

Terra Bella Tech Park, a 10-building office and research campus in Mountain View, shown within the outline. Boundaries are approximate. (Google Maps)

The lender paid $100 million through a foreclosure to take back a 10-building campus known as Terra Bella Tech Park. The trustee for the proceeding publicly posted the results of the foreclosure.

Related Articles

Family harvests millions from sale of longtime San Jose egg ranch

San Jose apartment complex delinquent on loan, faces foreclosure

Buyer emerges for East Bay hotel that faces foreclosure and bankruptcy

San Jose hotel sells for less than prior value in weak lodging market

Former men’s bathhouse property in San Jose lands new owner from Arizona

The unpaid loan debt at the time of the foreclosure proceeding was $123.1 million, the trustee’s report stated. No parties or individuals bid for the campus, allowing the lender to take the campus.

The foreclosed properties, which had been owned by affiliates of Zappettini Capital Management, are located near the interchange of U.S. Highway 101 and North Shoreline Boulevard.

Zappettini Capital, a real estate and investment firm with roots in the floral business, obtained a $120 million loan in 2019 from Citi Real Estate, according to Santa Clara County property records.

The loan foreclosure for the Mountain View tech park is the latest example of the financial problems that haunt the Bay Area office market. Sky-high vacancies, slumping rents, plunging property values and a growing number of loan defaults remain a challenge for many of the region’s office buildings.

The problems are severe enough that the delinquencies have resulted in loan foreclosures.

The Mountain View loan default and potential foreclosure are a stark contrast to a rosy assessment that Citi Real Estate Funding, German American Capital, and JPMorgan Chase Bank filed in 2019 regarding the tech campus, which is known as the Zappettini portfolio.

“The city of Mountain View is currently developing a growth plan, known as the Terra Bella Vision Plan, which is aimed at a complete redevelopment of a 110-acre area that includes the area where the Zappettini Portfolio Properties are located,” the companies stated in the filing with the Securities and Exchange Commission.

The financial firms deemed the proposal, crafted at a time when the Bay Area tech industry was riding a wave of enthusiasm, to be great news for the Zappettini buildings in Mountain View.

“The overall planned changes are expected to take place in the next three to five years,” the financial companies told the SEC in their filing. “It is expected that this will have a positive value impact on the Zappettini Portfolio Properties.”

This plan was floated before the onset of the COVID-19 pandemic, which triggered government-ordered business shutdowns and a more recent pattern of tech industry job losses and reductions in office space requirements.

Instead of rising property values for office buildings, the opposite has occurred.

In the case of the Zappettini portfolio, Citi Real Estate Funding is seeking payment in full of the loan and the additional fees and costs.

The building addresses are 1212, 1215, 1245, 1255, 1277 and 1305 Terra Bella Ave.; 1330 through 1350 West Middlefield Road; and 850-890 North Shoreline Blvd., loan documents on file with the county show.

The tech park’s buildings total 254,400 square feet, the LoopNet, Property Shark and Compstak databases show. The largest building totals 29,700 square feet. The smallest is 15,700 square feet.